GEICO Pet Insurance Reviews

Pet Insurance is regarded as a class of health insurance for your pets. This type of insurance offers insurance coverage on some kinds of illness and provides health care treatment for your pets such as dogs and cats at the least cost amount. With GEICO insurance agency, you can get a complete and affordable pet insurance coverage for your four-legged family members (dogs and cats). GEICO pet insurance saves you from high vet bills especially when your pets get injured or sick.

GEICO is popularly known to be one of the largest insurance companies in the United States. But the GEICO pet insurance is issued by Embrace Pet Insurance, a popular pet insurance company for dogs and cats. GEICO pet insurance policy offers comprehensive coverage that comes with optional wellness rewards. With this, you can select your annual maximum, reimbursement percentage, and deductibles which allow you to get a personalized cost effective policy that meets your budget.

Pros & Cons of GEICO Pet Insurance

* Affordable: GEICO pet insurance offers cheap insurance policy making it affordable for anyone unlike other pet insurance companies. * Big Discounts: any customer who takes its pet for insurance at GEICO stands the chance to get multiple discounts. For instance, you get amazing discounts from GEICO when you spray or neuter your pets. When you insure multiple pets and pay premiums annually, you also get up to 10%. * Wellness Coverage Options: one of the huge benefits of GEICO pet insurance is its wellness coverage. This is because this package is rare in other insurers. This benefits ranges from $250 to $650 annually. Some of the wellness options you get include preventive care, dental cleaning, vaccines, routine vet visits and spraying and neutering. * Alternative Therapies Coverage: GEICO pet insurance offers you coverage for alternative therapies. Some of the alternative therapies you get include physical therapy, acupuncture, chiropractor and reiki. |

* Policy comes through other insurer: Pet policies at GEICO are issued by Embrace Pet insurance. * Long Waiting Periods: if your pet has orthopedic issues or ligament sprains, you will get a six-month waiting period. * Limitation in some policy’s term: unlike other insurers, GEICO doesn’t provide you with annual benefits and 100% reimbursement plus it comes with 100% deductibles. * Upfront Vet Expenses Payment: it might take up to two weeks to get your reimbursement after filing a claim despite the easy process. This however depends on the size of your vet bill because some might be limited when it comes to pull payment. * Low-value wellness plans: only $25 saving is available for the plan’s full potential value after you pay your premium for preventive care. |

How Much Does GEICO Pet Insurance Cost?

There are several factors responsible for the cost of your plan. Some of these factors include deductibles, breed and type of pet, gender of your pet, coverage amount and location. According to GEICO.com, you can get some plans as low as $1 a day, however, the cost per for pet insurance can vary depending on the common factors stated earlier.

For instance, the age of your pet could increase your monthly premiums. Since wellness coverage has no deductible, waiting period, or co-pay, you can as well pay for more for your wellness coverage.

RELATED” >>>>>>>>>>>>>>> GEICO Insurance Near Me – Find a GEICO Insurance Agent Locations Near You

What Does GEICO Pet Insurance Cover?

GEICO pet insurance offers full coverage for your dogs and cats on the several health issues and injury listed below.

- Cancer treatment

- Accidents

- Surgery

- Emergency room care

- Hospitalization

- Breed-specific conditions

- Diagnostic testing and imaging (e.g. X-ray, Ultrasound, MRI)

- Nursing care

- Prescription drug coverage (optional)

- Dental issues

- Specialist care

- Veterinary exam fees

- Alternative therapies and rehabilitation

- Lab tests

- Microchipping

- Exam fees

Where Can You Find GEICO Pet Insurance?

You can find GEICO pet insurance in 50 states across the United States including the District of Columbia.

How Does GEICO Pet Insurance Work?

The first thing you have to do once you have taken your pet to the veterinary doctor for treatment is to file a claim, and if your claim is covered, you will get a check. Pet insurance policies at GEICO are issued by Embrace Pet insurance. This means any claims you filed, will be filed directly with Embrace. You can either file a claim via the official website or on the mobile app downloaded on your smartphone. On your mobile device, the digital claim is configured with a direct deposit to make reimbursement an easy process for you. The claim process usually takes about 10 – 15 working days for review plus an additional 3 – 10 days for payment to be received. Payment can also be received via check depending on the recipient.

RELATED”>>>>>>>>>>>>>>> Geico Insurance Review (2022)

Waiting Periods

GEICO pet insurance offers a short waiting period before your pets can be enrolled. This usually occurs when your coverage is restricted. The waiting period for accidents is 2 days while illness takes duration of 14 days and 6 months for orthopedic conditions. After the waiting period, coverage will only start only when each of the pets you want to insure has visited the vet within the past 12 months. On the contrary, if you have your pet and it hasn’t visited a vet in the last 12 months, it is advisable to take your pets in during the waiting period without any loss of coverage.

GEICO Pet Insurance Customer Service

If you want to make payment, change your deductibles; update your policy, add a new pet or perhaps you want to speak with a representative for any pet insurance services. The customer support group is available by phone. You can call 24/7 medical assistance on (800) 793-2003 and you can email the team from Mondays through Fridays from 9:00 AM to 8:00 PM (ET) and on Saturdays from 10:00 AM to 2:00 PM.

Final Verdict

You can get affordable pet insurance policies from GEICO that works with your budget when you want to insure your pets. When you register your pets for insurance, every treatment will be administered by Embrace, a popular and well-known pet insurance company. Keep in mind that in some instances, GEICO policies might be expensive for policies with lower deductibles and higher limits.

Related”>>>>>>>>>>>>>>>GEICO Insurance Login – How to Login to Manage Your GEICO Policy Account Online | Geico Customer Service

Geico Home Insurance Review (2022)

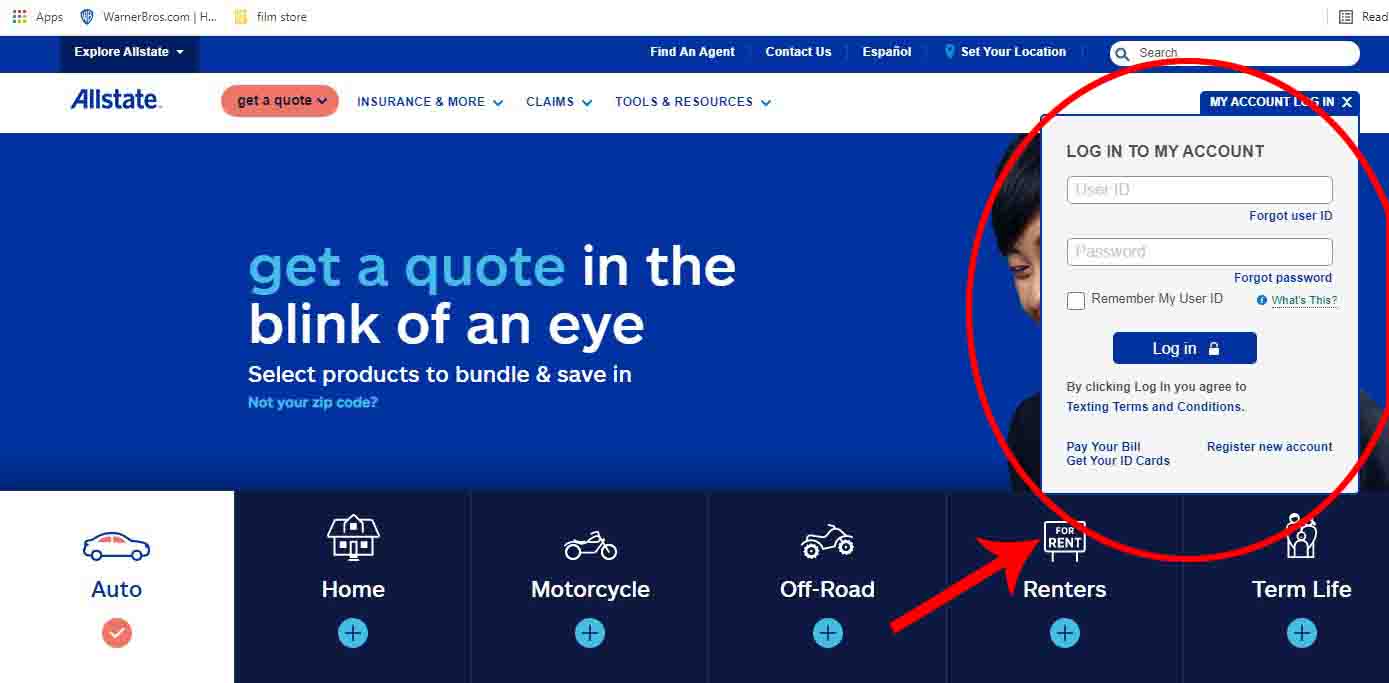

Allstate Insurance Near Me – How to Find an Allstate Agency or Agent Near You