Young adults in 2024 should purchase one of the best life insurance companies. In addition, the present moment is an ideal time in your life to make such a purchase. Life insurance is a key financial instrument that many people overlook. However, most young adults may believe it is not mandatory, but purchasing life insurance from one of the top companies in 2024 can be a wise option. Furthermore, purchasing life insurance ensures that your loved ones are financially secure in the case of the unexpected.

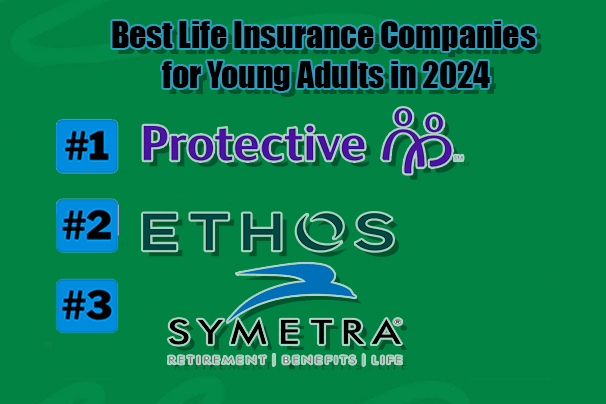

Best Life Insurance Companies for Young Adults in 2024

When looking for the best life insurance for young adults in 2024, start by reviewing the advice given below. Additionally, it covers information on durations, premium structures, cash value components, and everything else you need to know. Furthermore, if you are between the ages of 18 and mid-30, this article will guide you to choose the best company that meets your needs.

Protective

After reviewing 10 life insurance companies in 2024, we concluded that Protective is the best life insurance company for young adults overall. It’s also our top choice for the best term life insurance providers. Protective offers competitive term life insurance rates, making it a good choice for young adults looking for low-cost coverage.

Protective and Banner matched for the lowest term life insurance rates among the best companies in 2024. Additionally, it’s vital not only because of its low rates but also because it offers term lengths that go beyond the standard 30 years. The term options range from 10 to 40 years, giving potential policyholders more choice.

Ethos

Ethos Life is an innovative insurance company that can satisfy clients that are familiar with technology. The business, which was established in 2016, streamlines and expedites the life insurance approval process through the use of digital technologies. Additionally, Ethos provides term and whole life insurance with an entirely online application. However, whole life policies are not available to young individuals.

In addition, it indicates that Ethos’s term life insurance is reasonably priced for young adults in 2024, unlike other companies. Customers are unable to meet with local representatives for in-person support because Ethos is an entirely online supplier. Furthermore, Ethos offers general term life insurance rates for young adults, based on a 20-year policy with $250,000 coverage.

Symetra

Symetra is regarded as one of the best options for term life purchasers due to its inexpensive term life insurance prices. It also offers competitive coverage for cash value life insurance. Moreover, individuals under the age of 60 needing coverage of up to $3 million can take advantage of Symetra’s SwiftTerm term life insurance, which is reasonably priced. Furthermore, this coverage can easily be obtained without the necessity for a medical evaluation.

Brighthouse Financial

Brighthouse Financial provides excellent all-around life insurance policies for young adults aged 25 and above, offering immediate acceptance and no medical exam options. In addition, it provides coverage quantities up to $3 million and reasonable prices.

Generally, it’s a fantastic option for those who wish to obtain life insurance without having to undergo a medical exam. Furthermore, it also provides low prices, extensive coverage, and application decisions in as little as 24 hours.

Nationwide

Nationwide offers universal life insurance plans for borrowing in times of necessity. Over time, these insurances build up cash value that may be borrowed against. Additionally, the potential to use the accrued cash value to help pay for long-term care costs is one notable benefit. Moreover, this provision often extends the policy’s capabilities beyond those of ordinary life insurance, providing a useful financial resource for a range of purposes.

Nationwide’s universal life insurance policies are known for being incredibly versatile when it comes to premium payments and coverage. This flexibility guarantees policyholders the freedom to modify their coverage to accommodate changing financial situations while retaining control over their rates.

MassMutual

One of the biggest life insurers in the nation is Massachusetts Mutual Life Insurance Co., sometimes abbreviated as MassMutual. It was established in 1851 and provides a broad range of products. This includes variable universal life insurance, a permanent policy type with adjustable premiums and investment options, and term life insurance.

Being a mutual organization, MassMutual is partially owned by its policyholders and distributes dividends to eligible members. At over $2.2 billion, the dividend distribution in 2024 is expected to be the largest to date.

Pacific Life

Both term and permanent life insurance plans are provided by Pacific Life. It offers a broad range of universal, indexed universal, and variable universal life insurance products but does not provide entire life insurance. Additionally, both of its term life insurance policies can be changed to universal life with one more medical exam.

Moreover, obtaining term insurance allows you to convert it into a universal policy later, providing flexibility in selecting the right policy for your specific circumstances. The maximum death benefits for term life insurance plans from Pacific Life are subject to underwriting and begin at $50,000.

Mutual of Omaha

Mutual of Omaha is one of the top 10 life insurance companies for young adults who want to customize their coverage. The company offers a wide selection of riders and features, including disability income and return-of-premium features. Additionally, it also offers living benefits riders for terminal and chronic illnesses at no upfront cost.

Insurance options available to young individuals include final expense whole life, universal life, index-linked universal life, and term life. Furthermore, quotes can be obtained on Mutual’s website, but applications must be made through an agent.

Bestow

Bestow is a 2017-founded life insurance provider that provides term life insurance plans using a digital app that frequently provides quick choices. Those who appreciate convenience and are tech-savvy adults could find the company’s live chat option appealing. Additionally, Bestow provides term life insurance with no-exam plans and four term length choices. However, it does not provide permanent life insurance, and its term plans do not have renewal options. You can apply for new insurance at the conclusion of your current one.

Corebridge Financial

Corebridge’s Select-a-Term policy, formerly known as AIG Life and Retirement, provides exceptionally competitive prices that may entice consumers looking for term life insurance. Furthermore, it has exceptionally low rates exclusively for young people.

Buyers of term life insurance, on the other hand, can customize their coverage with term lengths ranging from 10 to 35 years, including alternatives such as 18 years. It employs an accelerated death benefit rider, which allows policyholders to receive rewards if their life expectancy is 24 months or fewer.

If you have no dependents and cover debts, life insurance may not be necessary. However, if your situation changes and includes loved ones, like young adults, who may face financial responsibilities, life insurance can help cover these costs.