If you require a significant amount of coverage that offers flexibility and could last for a lifetime (as far as you make payments), getting universal life insurance from one of the best companies might be right for you. Regardless of your challenges, most policies enable you to adjust your premium and death benefits. This occurs so you can spend your money wisely over time.

In this article, we have selected some of the best universal life insurance companies based on various factors. This includes their cost, rider options, client satisfaction, and more. In addition, these selected companies are worth thinking about if you are looking for strong universal life insurance.

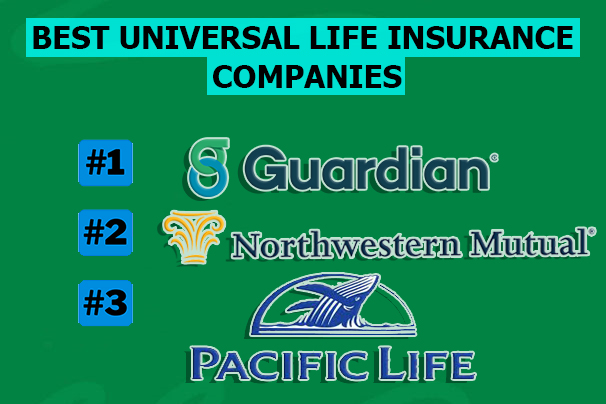

Best Universal Life Insurance Companies

Universal life insurance is one of the best life insurance coverages that is commonly known to policyholders as an attractive choice that offers coverage and death benefits. Moreover, considering both the insurance coverage and the ease with which plans may be used as investment vehicles, we selected the top companies of universal life insurance.

These are our best choices for the best universal life insurance companies:

Guardian

Guardian may be an excellent option for individuals searching for universal life insurance coverage without the need for a medical exam. In addition, this company has a unique feature that provides a no-exam UL alternative. It has been rated A++ (Superior) by AM Best, known as the highest feasible financial strength rating.

Moreover, this implies that Guardian has excellent financial management and the ability to cover any significant amount of claims. However, one disadvantage of this insurance provider is that it doesn’t provide online quotes for universal life insurance. This is due to its coverage complexity. Furthermore, to obtain coverage and quotes, it’s essential to reach out to your provider who offers Guardian products.

Northwestern Mutual

Northwestern Mutual is known as one of the oldest and largest life insurance companies. It was established in 1859, with a total market share of 9.02%. This provider offers traditional universal life (UL) and variable universal life (VUL). Similar to other UL policies, its custom UL policy produces cash value on a tax-deferred basis and features an adjustable premium and death benefits.

Moreover, similar features are also accessible in the provider’s VUL policy. This enables you to invest the cash value in a variety of subaccounts like mutual funds. It also has automated portfolio rebalancing and dollar-cost averaging. Furthermore, you can select from 40 various investment funds or get pre-packaged options that abide by various asset allocation patterns.

Pacific Life

Pacific Life provides both term and permanent life insurance coverage. Additionally, it offers a variety of universal, indexed universal, and variable universal life insurance coverage, excluding whole life insurance. With an extra medical exam, both of its term insurance policies can be switched to universal life insurance.

Furthermore, you can buy term insurance and change it to universal coverage at a later period. For this reason, it offers some flexibility when shopping if you are uncertain if the coverage is required for your circumstances. And every life insurance policy offered by Pacific Life needs to be obtained via an agent.

State Farm

State Farm provides a wide range of life insurance coverage in addition to home and auto insurance. It provides a coverage amount of $50,000 for individuals up to the age of 50 or for a 10-year term without a medical exam. In addition to other insurance products, it provides a range of choices for term, whole, and universal life insurance. Generally, it has excellent ratings for both customer service and financial soundness. Furthermore, the company is known for its high score among other companies listed (843 out of 1000), with the best customer service.

MassMutual

Massachusetts Mutual Life Insurance Co., also recognized as MassMutual, is one of the biggest life insurance companies in the nation. This provider was established in 1851 and provides a variety of products. This includes variable universal life insurance, a permanent policy type with adjustable premiums and investment options, and term life insurance.

Being a mutual life insurance organization, MassMutual is partially owned by its policyholders and distributes dividends to qualified customers. At over $2.2 billion, the dividend payout in 2024 is expected to be the largest to date. Furthermore, it supports online claims, but most policies necessitate a medical examination.

Lincoln Financial

Lincoln Financial may be an ideal option if you prefer flexibility and want the best permanent life insurance coverage. The company provides indexed universal life and variable universal life, among other types of UL coverage. Additionally, the provider offers an easy-to-use online interface where you may monitor your policy and make monthly payments.

Also, it offers a comprehensive range of financial products, including long-term care planning services and annuities, all conveniently located in one convenient location. However, Lincoln Financial’s customer satisfaction score is below average, and despite its strength, its financial strength rating is lower than some of its competitors.

Protective

Protective provides coverage for both permanent and term life insurance. Any of its permanent policies may be converted within the first five years of its term policies. It can only be converted to a whole-life policy after the first five years. Additionally, Protective provides 40-year term life insurance coverage.

Term life insurance policies typically have a maximum duration of 30 years. Protective’s website allows you to obtain a term life insurance quote, but you might need to speak with an agent to begin the application process. Protective Life provides various life insurance policies, including whole, universal, indexed, variable, and survivorship universal life, with coverage limits starting at $1,000 and $100,000, respectively.

Insurance providers set their qualifying requirements, so there is no universal life insurance list. For instance, certain organizations might provide easily qualified for no-medical-exam insurance. If you have significant underlying medical issues, you may face challenges in eligibility for certain services due to the need for a medical examination. Moreover, the best method to learn what requirements your selected organization has is to speak with a qualified agent about your circumstances.