Term life insurance is the easiest and most often affordable type of life insurance coverage with no assets or cash value to keep track of. It provides coverage to clients for a predetermined period, usually between 10 and 30 years.

A term life insurance policy can shield the people you care about from an unexpected loss of income in times of need, even while it won’t help you leave a financial legacy or help you accumulate an inheritance for your children. For instance, if you have small children or have objectives like paying off a house or your college tuition.

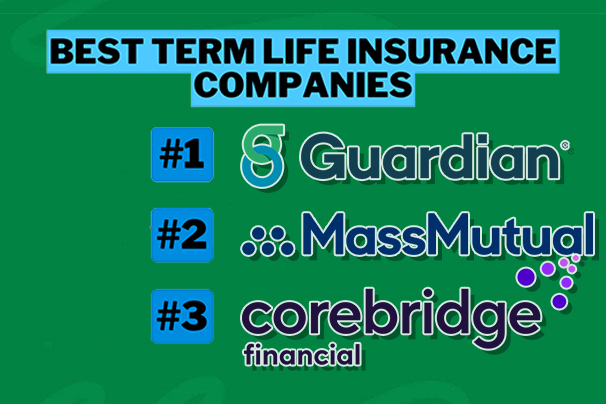

Best Term Life Insurance

It’s possible that the best term life insurance plan for you won’t be the best for another. When looking for life insurance, consider several aspects that may be more important to you than others. Furthermore, these factors include coverage amounts, term lengths, age limitations, and the ability to convert the policy to permanent coverage.

To help you choose the best policy for you and your family, we have featured term life policies from some of the top US life insurance providers.

Guardian

Guardian is the best-term life insurance company because of its flexible policies and excellent financial stability. It can be altered into a permanent life insurance policy without a medical exam. Especially, if your circumstances change during the first five years of your term life insurance.

Additionally, you can convert a level-term policy to a permanent life insurance policy by adding a rider. Furthermore, it offers coverage amount of $5 million maximum for term insurance which are available within 10, 15, 20, and 30 years. Lastly, the age range is 18 to 75.

MassMutual

Term life insurance coverage from MassMutual comes in increments of 10, 15, 20, 25, and 30 years. The company also provides an annual renewable term life policy. However, if you go with that option, you will eventually pay greater premiums and the policy renews annually. Additionally, it has a maximum issue age of 75 and a starting coverage amount of $100,000.

You have until the time frame mentioned in your policy documentation to switch to permanent life insurance. Parents or guardians of a child under the age of 18 may get free insurance, especially, if the family’s annual income falls between $10,000-$40,000. However, if a parent or guardian passes away, the $50,000, 10-year policy which assist in covering the cost of the child’s education.

Corebridge Financial

Generally, Corebridge is term life insurance which buyers would find the Select-a-Term policy to be a very reasonable price rate. It also provides a wide range of term options, ranging from 10 to 35 years with a minimum coverage amount of $100,000.

In addition, it offers extremely cheap prices for term life insurance with the highest age range at 80 years. Furthermore, it has a life expectancy of 24 months or less to use the expedited death benefit rider which many rivals need 12 months or less.

Pacific Life

Pacific Life provides two-term life insurance coverage. Additionally, it offers personalized coverage amounts, term ranges, and riders. This includes an Accelerated Death Benefit Rider or a Chronic Illness Care Rider, offered by the corporation in its term insurance. Additionally, an agent is required to obtain a conventional term policy with a duration of 10, 15, 20, 25, or 30 years.

Term insurance policies from Pacific Life may also be converted to permanent life insurance. Moreover, you might not require any additional underwriting, depending on the policy and how long it was issued. Through its Elite Term policy, it offers coverage starting at $750,000 and up to $3 million or more.

Ethos

Ethos offers a simplified, entirely online application that you can complete from the comfort of your home, making it the best no-exam term life insurance. As an independent broker, it offers term and whole life insurance through partnerships with other providers. This may include TruStage, Mutual of Omaha, and Ameritas.

Upon your application for term policy through Ethos, the underwriting procedure is started by the company without a medical exam. Additionally, you can select between terms of 10, 15, 20, and 30 years, with coverage ranging from $20,000 to $2 million. It also provides applicants between the ages of 66 and 88 with guaranteed-issue whole-life insurance without the need for a medical exam.

Furthermore, the company offers coverage in minutes and has a quicker application process than some of its competitors, but has a whole life-death benefit of $30,000.

State Farm

State Farm gets the best customer satisfaction J.D. Power score. It provides a variety of term insurance policies, but for some term life insurance policyholders, its return-of-premium policy choice might be especially useful. Moreover, State Farm Policyholders can select a 20- or 30-year payout term with this add-on coverage.

Also, it’s known as a life insurance rider, and receive a portion of their premiums if they outlast the term. Furthermore, it lasts up until the age of 95, then the return-of-premium policy may be renewed yearly. Although there is an additional fee associated with the return-of-premium option, it also generates monetary value. Lastly, this is uncommon in term life insurance policies.

Symetra

SwiftTerm from Symetra is the best choice for individuals searching for affordable term life insurance because it has the lowest rates among all the life insurance products we analyzed. Moreover, prompt approval may also be granted to eligible candidates. Additionally, the bare minimum for coverage is $100,000 with terms offered within 10, 15, 20, or 30 years.

Protective

Our Protective is the best term life insurance because of its affordable coverage, excellent online features, sound financials, and no-exam policies. It’s also our best choice for young individuals’ greatest life insurance providers. After comparing quotations from a sample of applicants, Protective and Banner tied for the lowest cost term life coverage.

Furthermore, the two companies that provide a 40-year term which is Protective and Banner. Additionally, it’s one of the longest terms and both firms offer a variation of benefits, such as online life insurance rates and applications and no-exam life insurance. Furthermore, Protective emerges victorious due to its substantial coverage limits, which go up to $50,000,000.

Amica

Amica provides term and whole-life policies, which are fewer coverage options than its rivals. However, what makes it unique is the abundance of discounts that are offered. The company’s online applications and quotations might make the process easier for people who are certain they want term life coverage.

Additionally, certain individuals in higher rate groups can forego the medical examination. Furthermore, bundling might reduce your auto insurance costs by 10%.

Northwestern Mutual

Northwestern Mutual is a good option for customer experience since, in comparison to other insurers on our list of the best policies, it received fewer complaints proportional to its size. If you compare premiums to level-term policies, they are initially quite affordable, but as you age, they rise. Additionally, annual renewal of coverage occurs automatically. The insurer provides a policy with consistent premiums for the first ten years of the policy’s coverage.

Conclusion

The best term life insurance policy for you is one that reasonably covers the amount you require and meets your unique demands and lifestyle. Moreover, consider underwriting requirements, customer satisfaction, and financial strength rating.