If you want to learn the easy guide on how to apply for a home loan and you don’t know how to go about it. This post will guide you on the required steps to take to make your mortgage application process easier by following the steps below to apply for a home loan to avoid any delay and also saves time.

1. Gather your Financial Documents

When you want to field answers to home loan application questions, it is very important you have the right mortgage document available so that you have a smooth mortgage application process. Below are the things you need;

- Full name: list your full legal name, add suffixes in the empty specified field

- Address: you will have to provide the address of your residence where you have lived for two years. This information will be added to your credit report

- Total Asset: get bank and retirement statement for the past two months from the bank. You also get information about your 401(k) or retirement funds.

- Dependent: this includes information about the ages and number of children.

- Employment and income information: gather your W-2s for the last two years and your pay stub. On your W-2s, you will be asked to provide your company name, address, and phone number for your current employer.

Special document for Special situation

- Bankruptcy documentation

- Co-applicants loans

- Proof of child support you pay or receive

- A divorce decree (to show debts paid by an ex-spouse)

- Federal or past-due tax payment plans

- Business and personal tax returns (if you are self-employed).

2. Know and Understand the basic mortgage loan requirements

You must get yourself familiar with the minimum mortgage requirements. These basic minimum home loan requirements include debt-to-income (DTI) ratio, credit score, and assets.

DTI ratio: this is an important factor that will be used to determine if you can repay back the loan. Lenders advise borrowers to have a DTI ratio at or below 43%. Keep in mind that your DTI ratio is calculated when your total debt is divided by your pretax income.

Credit score: To get a mortgage with a lower rate, you will need a credit score of 740 or higher. Sometimes a low credit score of 500 may get your approval for a mortgage application but will come with a 10% down payment. You can improve your credit score by making payments on time.

Assets Verification: when you are applying for a home loan, lenders will consider three factors related to your assets.

- How much you have for a down payment and closing costs

- How the money got there

- How much extra money you have.

Loan-to-value ratio: a loan-to-value (LTV) ratio measures the percentage of your home’s value you want to borrow in a mortgage. LTV ratio affects your interest rate, monthly payment, and how much you can borrow.

READ ALSO >>>>>>>>>>>>>>> SBA Economic Injury Disaster Loans – How to Apply for Economic Injury Disaster Loans (EIDL)

Pandemic Unemployment Assistance – How to Apply for Pandemic Unemployment Assistance Program (PUA)

3. Choose the Right Mortgage Type

There are different types of mortgage programs you can qualify for. This will however be determined by your loan officer. Below are the types of mortgages you can qualify for.

| Loan Type | Why you should choose the Loan Type |

| 30-year fixed | This offers the lowest fixed-rate payment |

| 15-year-fixed | This offers you access to pay off your loan faster at a lower rate |

| FHA | You have a credit score of 580 and can make a 3.5% down payment You have a credit score of 500 and can make a 10% down payment |

| Conventional | You want to make a 3% down payment and have a credit score of at least 620 |

| VA | You’re an eligible active-duty service member, veteran or eligible spouse You don’t have money for a down payment You don’t want to pay mortgage insurance You want the flexibility of a program with no minimum credit score |

| USDA | You want to buy a home in a rural area with no down payment You earn a low-to-moderate income |

4. Take Note of the Factors that are not on the Mortgage Application

It is very important you apply for a home loan that meets your budget and can help your homeownership cost into consideration. However, despite all you are spending on your mortgage, keep the expenses below in check.

- Childcare costs

- Health care expenses

- Education goals

- Utilities

- Groceries

- Savings goals

5. Compare & Choose the Right Mortgage Lender

One of the best ways of getting a good lender before applying for a home loan is by comparing various lenders so that you can choose an affordable lender that can meet your budget. You can get your home loan from the various lenders below.

- Institution banks

- Mortgage banks

- Mortgage brokers

6. Fill Out a Mortgage Application

Once you have completed the steps above, now is the best time to decide on how to apply. Your loan estimate (LE) will be provided by your lender to give you an overview of your mortgage before application. You can apply through the following;

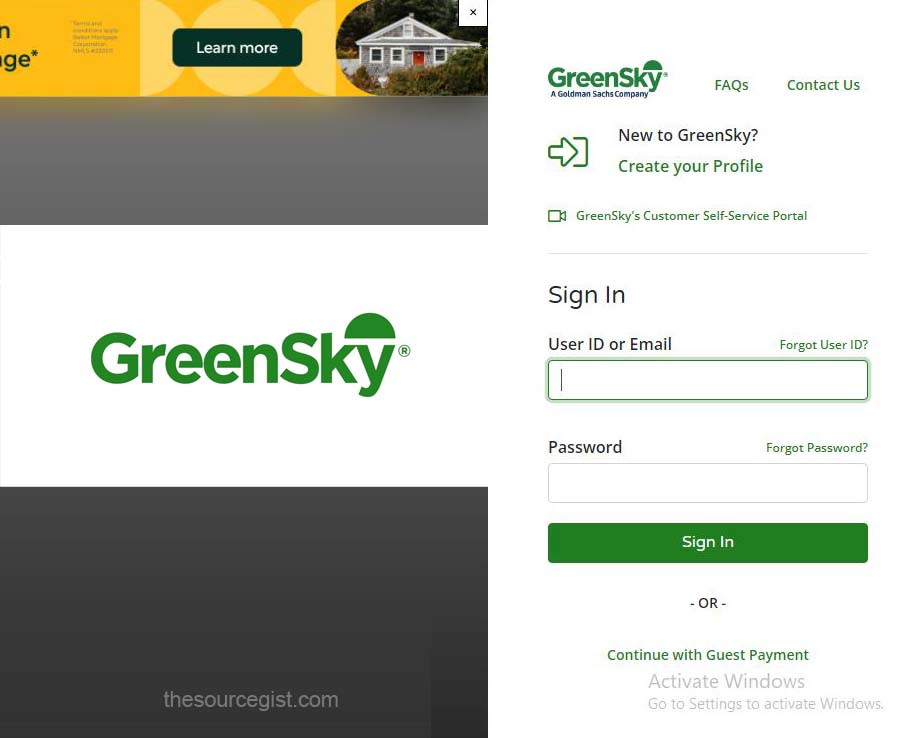

- Online Application: You can make use of your PC computer or mobile device to apply.

- Phone application: you will have to speak with your loan officer who will guide you on which way to go.

- In-person application: you will have to visit the office of the lender and apply in person.

RELATED ARTICLES >>>>>>>>>>>>>> Federal Student Loan Login – Login to Manage your Federal Student Aid Account

Aidvantage Student Loans Reviews – Everything You Need to Know

How to Get the Best Loans for Students