How can I get the best loans for students? First and foremost, it is important you get familiar with the various types of loans that are available for students which you can borrow money from to cater for your college expenses. You have to know that when you are borrowing a loan, you must pay back with interest.

As a student, you can either get federal student loans which are offered to you by the federal government or private student loans which are provided by private sectors which include online lenders, banks and other financial institutions.

Federal student loans provides student borrowers with a lot of benefits when you compare it to private loans, but the downside of Federal loans is that they are restricted to U.S. citizens and eligible non-citizens. This implies that many international students may not be able to access Federal student loans. In this case, private student loan is the best option to borrow a loan that can pay for your college cost.

Types of Loans for Students

We have two popular loans which you can borrow money from as a student. They are federal student loans and private student loans.

Types of Federal Student loans

There are three major types of federal student loans and these loans are funded by the federal government through the Federal Direct loan program. The types of federal student loans include;

- Direct subsidized loans: this type of federal student loans is issued to student or borrower when they show interest on financial need.

- Direct Unsubsidized Loans: this loan type is when the borrower or student did not show any interest on financial need. However, your school will determine the amount of loan you want to borrow, number of attendance and other financial aid you getting. They are not credit-based.

- Direct Plus loans: this is also regarded as Parent PLUS loans and are credit-based. This type of federal student loans is given to parent and graduates or professional students.

RELATED”>>>>>>>>>>>>>> How to Get Federal Student Loans

Types of Private Student loans

Private student loans are loans provided to you by private financial institutions and other online lenders. You can get private loans from the following;

- Banks: you can get a loan from a local bank but it will require your personal information and other financial documents. Some of the banks include Citizen One, PNC bank, Discover banks and many more.

- Online lenders: you can also get a student loan from online lenders but this will require your credit score and other important information. Plus, this loan comes with high interest rates (except you have a co-signer), repayment terms and many more.

- Parent loans: this loan type requires a parent or any other creditworthy individual will take out the loan on behalf of their student and then help their student pay for college.

RELATED”>>>>>>>>>>>>>>>>> Best Private Student Loans for International Students

How Can I Apply for Federal Student Loans or private Student Loan?

Applying for either Federal or private student loans take different approaches. This means the application processes is different for the two.

How to Apply for Federal Student Loans

To apply for federal student loans, you must start by filling out the Free Application fir Federal Student Aid (FAFSA) and then submit the application form when you are done to qualify for the federal student loan.

Quick Tips for FAFSA

- It is completely free and you do not have to pay any money. However, you must apply and fill out the form using the Federal Student Aid website.

- FAFSA rolls out every year after October 1. Kindly visit the FAFSA website to know the deadline for the state’s college you want to attend.

- Complete the FAFSA form every year to get your money to cater for your college expenses

How to Apply for Private Student Loans

To apply for private student loan, you can do this by following the instructions below;

- Start by going to the lender’s website

- Next, compare the interest rate of the loan, repayment terms and other options.

- The next step is to apply directly on the website. You will be asked to select the type of repayment options and interest rate type you want.

- For some lenders, you may be asked to add a cosigner which may give you higher chances of getting the loan.

- Next, the lender will check your credit score and other requirement to give you an offer.

How to Accept for your Federal or Private Student Loans

To accept a federal student loan is easy. You can do this by signing and returning your financial aid offer. To make sure you have a thorough idea of your loan obligations, you will be asked to engage in an entrance counseling exam at your college and also sign a Master Promissory Note (MPN) to agree to the loan’s terms.

To accept a private student loan after your loan is considered, you must check the following before accepting the loan.

- Compare the best and lowest interest rate and long repayment terms options for your loan from the lenders

- You or your co-applicant will accept the terms of your loan and sign it electronically

- Your college will be asked to certify your qualification which includes verifying your enrollment and the amount of loan you have requested.

Keep in mind that you have to pay back both loans either for private or federal student loans. Although, it is recommended you go for federal student loan first before considering the private loan.

How to Repay Your Private and Federal Student loans

- You have a grace of six-month period to repay your federal student loans. Though, you can still repay your federal loans after graduation but you must still repay it. You can make use of the principal and interest payments.

- For private student loans, you will get a due date as issued by the lender.

Responsible Ways to Borrow for College

- Begin by getting scholarships, grants and work-study regarded as free money before you start thinking of getting a loan

- Try federal student loans first

- Next, consider a flexible private student loan

RELATED”>>>>>>>>>>>>>>>>No Credit Check Loans with Guaranteed Approval Online

How to Apply for Student Loans: Step by Step Guide

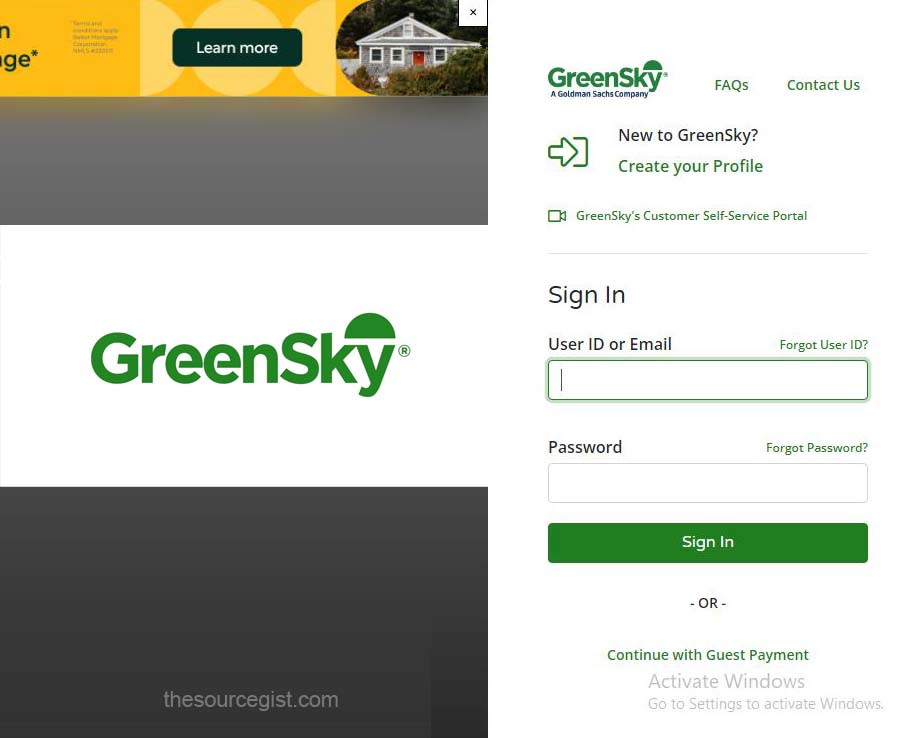

Student Loan Login – Log in to Manage your Student Loans | Federal Student Aid Login

Aidvantage Student Loans Reviews – Everything You Need to Know About Aidvantage Student Loans