Whole life insurance offers long-term coverage for permanent life and allows you to borrow against the policy’s cash value. This policy provides permanent life insurance coverage for people aged 95 to 121, assuring coverage for their whole lives. Although most people prefer term life insurance, whole life insurance provides greater benefits for a higher price. This is an excellent resource for people looking for the best whole life insurance companies of 2024.

Whole life insurance companies in 2024 will provide full coverage to protect your financial assets as well as your death. However, it has a significant financial impact. The 2024 list of the best whole life insurance companies was compiled by several providers after considering several factors. This includes customer satisfaction, insurance options, dividend performance, coverage levels, and financial stability.

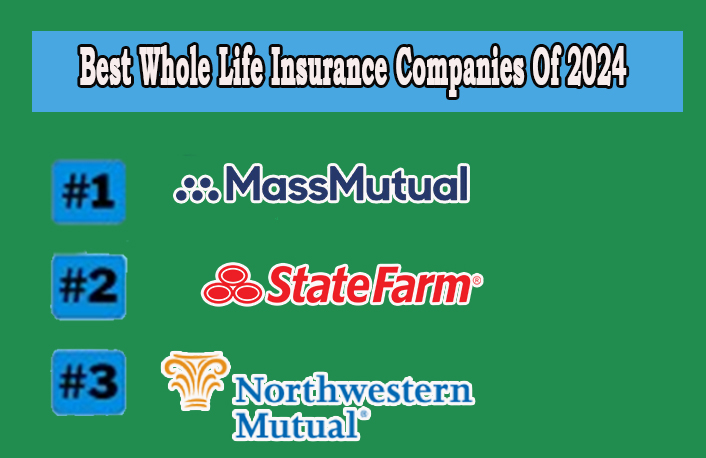

Best Whole Life Insurance Companies Of 2024

Whole life was the most popular policy type among multiple life insurance purchasers. This coverage provides both lifetime protection and cash value, which can be accessed at any time during your life. Whole life insurance products provide a death benefit, stable premiums, and increasing investment returns over time.

The companies listed below offer the best whole insurance in 2024 which includes;

MassMutual

MassMutual is our top pick for 2024’s best whole life insurance companies. It is a mutual business that distributes annual dividends to policyholders. It has regularly paid them annually for almost a century, even though they were not guaranteed. The company offers many rider options for its whole-life plans, such as a disability premium waiver, guaranteed insurability, and extra life insurance. Furthermore, this enables you to raise your premiums to include your policy’s death benefit and cash value.

State Farm

State Farm comes in second place for receiving the highest rating for both whole life insurance performance and customer service. It received half the average number of complaints expected for its size and had the highest customer satisfaction rating. This suggests that there’s a good chance your interactions with the company for inquiries and policy modifications will go well.

In addition, State Farm ranked highest in financial strength, cost competitiveness, policy prediction accuracy, and cash value accessibility. Furthermore, State Farm’s cash value investments have performed poorly compared to the industry average over the past five years.

Northwestern Mutual

Northwestern Mutual offers competitive whole-life insurance for a variety of age groups and health concerns, all with strong financial stability ratings. Furthermore, the organization offers dependable policy illustrations and entire life insurance plans with early access to cash value. The company boasts superior financial strength, high-reliability policy illustrations, lower internal policy costs, enabling lower premiums and faster cash value growth compared to competitors.

New York Life

One of the biggest providers of life insurance in the nation is New York Life. In addition, it has the second-longest dividend payment history (Penn Mutual beats it, having paid dividends since 1847). The company offers accelerated death benefit riders on its whole-life policies, allowing early access to part of the death benefit in cases of chronic or terminal illness.

A premium rider disability waiver is also provided. New York Life is an excellent choice for older adults seeking permanent coverage because it provides insurance to those over the age of 60. It’s also our #1 choice for senior-friendly life insurance.

Penn Mutual

Penn Mutual’s financial soundness and minimal internal expenses attract whole life insurance buyers, allowing more money to be put in cash value. It offers a strong asset management that may result in a greater increase in cash value and death benefits for policyholders.

Penn Mutual’s whole-life insurance provides early access to cash value, outperforming competitors and investing in historical returns. The policy has three options: Guaranteed Whole Life II, Protection Whole Life, and Survivorship Whole Life, all of which start at $50,000 and are good until age 85.

Nationwide

Nationwide is rated as top whole life insurance due to its financial stability and high customer satisfaction ratings. The 20-Pay Whole Life option accelerates cash value accumulation, especially during peak working years and retirement. Furthermore, the Whole Life 100 option offers a cheaper, fixed premium until the age of 100, making it suitable for cost-conscious customers.

The policy provides flexibility with two payment choices, with premiums payable until age 100 or 20. Furthermore, it accelerates underwriting which allows applicants aged 18-50 to get up to $5 million in whole-life coverage without a medical exam.

Guardian Life

Guardian Life offers a wide range of whole-life products, including HIV-positive life insurance. You can choose between level premiums or a limited payment policy with Guardian’s whole-life coverage, allowing you to pay off your policy in 10, 15, or 20 years. In addition, there are no premiums needed to maintain your coverage.

The selection of riders includes long-term care, index participation feature (IPF), and disability waiver of premium riders. To be eligible for term and whole-life policies, individuals must demonstrate successful antiretroviral therapy and specialist care.

Mutual of Omaha

Above all, Mutual of Omaha Life Insurance is renowned for its sound financial standing. It provides a range of riders and plans, including no-exam life insurance policies. For applicants between the ages of 50 and 75, some policies have a $1,000 maximum. The maximum benefit of a life insurance policy for healthy applicants who want to avoid a medical exam is $25,000. Mutual of Omaha’s no medical exam life insurance policies has a two-year waiting period after approval.

Final Thoughts

Whole life insurance policies offer lifetime coverage and often include a cash value component. In the event of death, the beneficiary receives a guaranteed death benefit that may be dispersed to many recipients. We assessed eight insurance companies that offered whole-life plans in 2024 to determine which were the best.