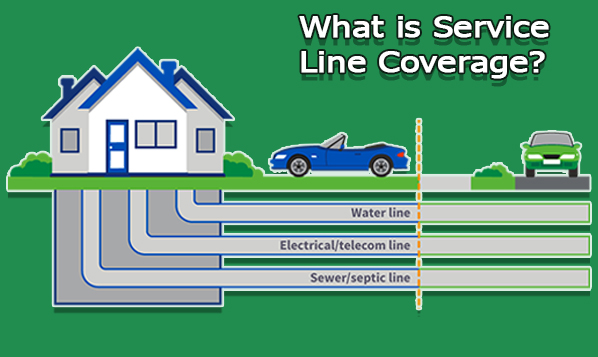

Many homeowners may be unaware that they are responsible for maintaining and repairing some faults in the building. This may include the water, sewer, gas, and electrical lines that connect their property to public connections. The cost of repairing can be high when they break or get damaged, leaving homeowners with unforeseen bills. Service Line Coverage can help with that.

By helping to pay for the replacement or repair of these service lines, your home insurance policy protects you from the financial strain that may be costly and inconvenient. You can rest easy knowing that you’re protected in case these connections break down or are damaged thanks to Service Line Coverage.

What is Service Line Coverage

Service line coverage is an insurance policy that covers the cost of repairs to underground utility lines on your property. It offers coverage for certain damage. This may include wear and tear, leaks, root invasion, electrical or mechanical failure, obstruction, corrosion, disconnecting, excavation, freezing, and rodents or animals. A deductible, or the amount you must pay in a claim, is frequently associated with service line insurance. For instance, after deducting the $500 deductible, the insurance company would pay the remaining $2,500 if a huge truck unintentionally crushed an underground sewer line.

How Does Service Line Coverage Work

The cost of service lines or pipes that run across a homeowner’s property is $2,556 per year. To pay for expensive water and sewer line maintenance, homeowners can sign up for a utility company service plan. Their monthly utility bill now includes this expense. A service line endorsement covers all utility lines and does away with the need for several service plans.

However, this can be added to their homeowners’ insurance policy to simplify it. Additionally, water, steam, sewer, drain, electricity, fiber optics, cable, internet, and natural gas pipes are usually covered by service lines. Service line coverage pays for excavation, replacement, repair, and landscape restoration in the event of a line or pipe leak. Furthermore, businesses provide coverage in sums between $10,000 and $25,000.

What Does Service Line Coverage Cover

There are several damages to underground utility lines on your property that may be covered under service line coverage. The following kinds include;

- Steam.

- Sewage.

- Water.

- Cable or phone.

- Gas.

Services like excavating, repairing damaged pipes, and repairing disturbed landscaping may be covered by your policy. Your coverage may also pay for a few days of hotel accommodations if your home becomes uninhabitable. Moreover, to replace your outdated service line with more eco-friendly or efficient equipment, several insurance companies might provide a little additional option.

What Does Service Line Coverage Not Cover

In most cases, above-ground utility line repairs are not covered by service line coverage. Additionally, the coverage might not cover damage to liquid fuel tanks, septic systems, or water wells because it is intended for utility connections that connect your house to a commercial or municipal service.

Why Do I Need It

The expense of excavating for damaged lines, including damage to trees and plants, patio excavation, and house relocation, is covered by service line coverage. It offers financial support when the homeowner is unable to dwell in their house while the damaged line is being repaired or replaced. This is because the damage is unmanageable.

How Much Does It Cost

When calculating insurance costs, several factors are taken into account. The cost of your service line coverage may increase due to these reasons. Costs for service-line insurance, however, differ depending on the insurance provider. To determine the cost of adding this coverage to your house insurance policy, you will need to get in touch with your insurer.

Is It Worth It

If you have huge trees with roots that potentially encroach on underground pipes or reside in an older property with outdated utility lines, you can add service line coverage to your policy. This simply means that it would become additional coverage. If your home is brand new, you reside in a remote location with few municipal services, or you feel comfortable paying for unforeseen costs if one of your utility lines fails, it might not be helpful.

Alternatives to Service Line Insurance From Your Home Insurance Provider

You can get service line insurance from your city or utility company or home warranty providers like HomeServe and Service Line Warranties of America. Before making a purchase, it’s crucial to evaluate the conditions and prices of each plan.

Other service lines may be covered at a reduced cost by homeowner’s insurance. For example, the Service Line Protection Program of the New York City Department of Environmental Protection costs around $85 for water lines and $143 for sewer lines annually, for a total of $228 for two utility lines.