Policyholders are frequently left to cover any remaining expenses out of pocket when policies do not cover the claim or the extent of an incident. However, contractors can use umbrella and excess liability insurance to guard against these losses. Having these insurance policies is crucial, regardless of whether you work in an office or in construction. But what’s the difference between excess and umbrella insurance?

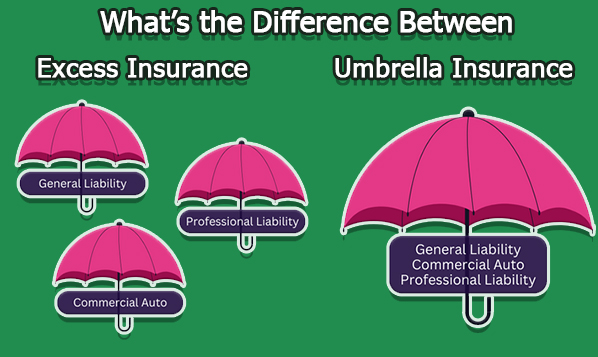

What’s the difference between excess and umbrella insurance is a question most people ask because these policies provide extra liability coverage beyond your current insurance. Umbrella insurance offers comprehensive coverage across multiple policies, including home and auto. However, excess liability insurance raises a policy’s limits. You can choose the kind of coverage that best meets your needs by being aware of the main difference between excess and umbrella insurance.

What Are Underlying Policies

The insurance plans you now have in place to safeguard your company would be considered underlying policies. A particular, focused area of protection will be offered by these policies. Here are a few instances of underlying policies:

- Commercial auto insurance

- General liability

- Pollution liability

- Professional liability

- Employee compensation

- Additional industry-specific coverage

It is crucial to remember that the following list only includes liability coverage. Regardless of whether you buy an umbrella or excess insurance, it will simply offer more liability protection. In no case does an umbrella or excess policy provide property coverage.

What is Excess Liability Insurance

One kind of insurance coverage that provides greater protection than the underlying policy is excess liability insurance. The policy provides additional coverage and security when the insured person’s initial policy is depleted following a claim, offering increased limits beyond the insured’s initial coverage.

Similar to purchasing an insurance plan, excess liability insurance makes sure that everything is covered even in cases when the insured’s primary policy has surpassed its limits. It can only be applied to a single underlying policy. Therefore, if the insured has excess liability on their auto insurance and other insurance policies from the same provider, it won’t transfer to their homeowner’s insurance.

Who Should Get Excess Liability Insurance

While excess liability insurance is an extra layer of protection, not everyone requires it. You might not need to purchase this extra coverage if you don’t have many assets or a lot of property to safeguard. However, obtaining excess insurance coverage may be advantageous if you stand to lose a lot and are at risk of being sued. Having an extra liability policy could be advantageous for people who live in residences that are susceptible to damage or who work in occupations where they may be sued.

What is An Umbrella Insurance

One kind of policy that offers more liability protection than your existing insurance policy is umbrella insurance. This option is based on a vehicle insurance policy, but it may be expanded to include homeowner, watercraft, ATV, RV, and many other types of plans. This insurance covers the policyholder against a significant liability claim or judgment that exceeds the limits of your liability policy. When the insured’s underlying responsibility limits are reached, it takes over.

An umbrella insurance policy will typically include

- Bodily injuries claims

- Personal injury claims

- Damage to property

- Landlords liability

Generally, umbrella insurance won’t cover;

- Individual possessions

- Businesses losses

- Criminal or deliberate actions

- Oral or written agreements

Who Should Get Umbrella Insurance

The coverage offered by an umbrella insurance policy may surpass the limitations of your homeowners’ and auto insurance policies. It usually makes more sense to have umbrella coverage if you have assets to protect, as the purpose of an umbrella insurance policy is to protect your assets in the event that you are ever sued.

If the policyholder has a net worth of more than $1 million, several insurance companies would advise you to purchase an umbrella policy. On one of these plans, this is also the minimum liability amount. Anyone with assets worth more than the liability coverage they have for their home or auto insurance policies is thought to benefit from umbrella insurance.

What’s Major Difference Between Excess and Umbrella Insurance

In summary, you should be aware of what’s the main difference between umbrella and excess liability insurance:

- Excess liability gives your underlying policy more limitations, but it has no bearing on the actual terms of your insurance (unless it has extra exclusions).

- However, umbrella insurance may offer more comprehensive coverage than your primary policy.

Which Is Better, Excess and Umbrella Insurance

Generally, excess insurance is adequate. You should review your underlying policies if you are worried that a loss won’t be covered. The goal of purchasing umbrella or excess insurance should be to offer additional protection in the event that a loss exceeds the policy’s limitations.

An excess policy can be your sole choice, depending on the business’s particulars and/or industry. Certain sectors will stipulate that to get a contract or be chosen for a position, an umbrella policy is necessary. If a contract is the primary purpose for obtaining this kind of coverage, it will be crucial to ascertain which is necessary.